Slice pay as they say is Indian fintech startup focusing on revamping financial experience of millenials. It was founded way back in 2015 by IITians Rajan Bajaj and Deepak Malhotra under their company Garagepreneurs Internet PVT Ltd. Slicepay in 2016 started as credit lending platform mainly for students to meet there financial needs and later in 2019 turned to Slice credit card.

As the title suggest ‘cashback card’, from being just loan lending platform, slicepay have now become new generation rewarding credit cards with its offers. In this blog post, I will give you a walkthrough to features, benefits, charges and registration process of Slice card.

Slice Credit Cards Features and Benefits

Slice credit card is offered by Garagepreneurs in partnership with SBM Bank. There main audience are students or young people who don’t have credit history or income proof to apply for credit cards. Slice card started with Rupay but now offer Visa Platinum card with zero joining or annual fee with no hidden charges. You heard right, lifetime free Visa Platinum card.

The card is very good for individual to start building there credit journey or CIBIL score with this free credit card. Slice card is modern credit card with wave feature and can be fully controlled using Slice app. Some of the benefits of Slice credit card –

- No upfront, joining, anuual or hidden charges.

- Buy now from credit limit, pay later at no extra cost.

- No cost EMI on top online brands while shopping online. You can extend upto 18 months low cost EMI.

- Emergency loan into your bank account or Paytm wallet.

Slice credit card does not have any reward system but what you are going to read next is far better than any other rewarding points credit cards.

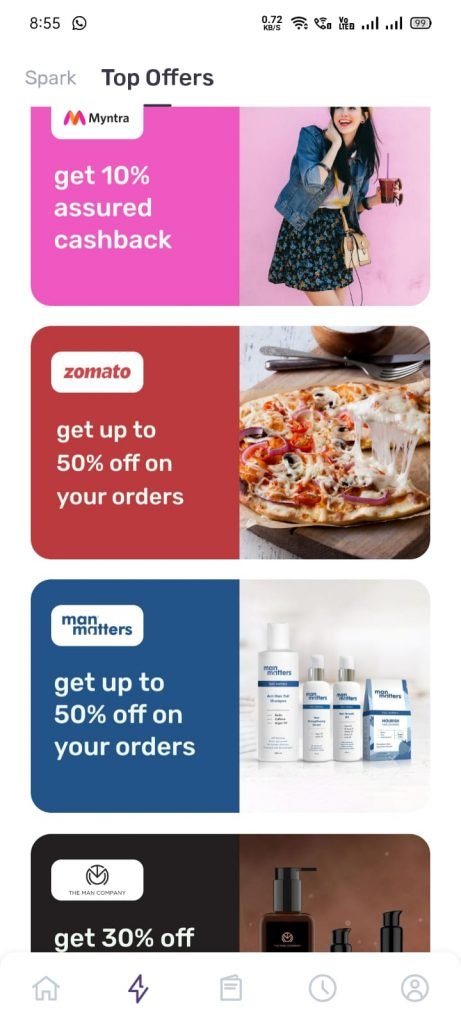

Slice Spark Offers

Spark offers is what makes Slice so special and a best cashback credit card. This was recently introduced within there app where they offer best offers and cashbacks from top brands. When I say cashback I don’t mean gimmicky ‘upto’ cashback like Google pay or rewards points that credits after 90 days without any track but straight, flat and instant cashback. Here’s short teaser of what Slice spark is:

You can track those cashback in realtime within Slice app passbook. Other than this, it also has tab called ‘Top offers’ where you can find more offers along with Visa platinum offers. Spark offers are available for short tenure and updates frequently(3-6 days) whereas top offers runs for longer durations.

Slice Credit Card Registration And App Overview

Anyone who wants Slice credit card can apply for it via Slice app. The process is completely paperless and only eligibility required is 18+ age and Indian resident. The maximum credit limit you can get is up to 2 lakh rupees. The application form is a kind of questionnaire where you have to fill in all your personal details and financial details like all other credit cards.

The only extra information asked here is detail about one of your friends in contact. It could be that when you are not able to repay card bills, they will nag your friends. In any case, you should always do repayment on time to maintain your credit score. It usually takes 24 hours for approval if your application meets requirement.

The Slice app is very straightforward with no extra mess. You have card details and credit limit on main screen, spark offers in second tab. You are allowed to change pin, edit transaction limit and block card from app. There is passbook within app to track and categorize all your spending and cashback. The cashback you earn automatically adjust to your dues instantly.

Slice Credit Card Charges And Support

The Slice card does not have any joining or annual charges nor any hidden charges. You have to repay credits used by the 5th date of next month. You can pay in single installment with no extra charge via UPI or else can convert it to installments. Interest charges are levied as per installments plan you choose. But if you do not pay on time there are certain late charges like other credit cards.

Late fee charges are payable on and from the 4th day of the relevant installment becoming overdue.

(a) The default charges will be calculated @ INR 35/- per day for such a period; during which the default continues subject to a maximum limit of INR 2,000/-

OR

(b) 30 % of the outstanding amount.

More info – https://help.slicepay.in/hc/en-us

I encountered Slice support only once and the experience was good. The customer experience team is polite and is always in touch even if the resolution is going to take time. You can submit tickets/queries within app and track the status. Turnaround time is maximum 24 hours.

Should You Get Slice Credit Card?

The conclusion is very clear here. If you are student, you should get it to start building your credit score. If you already have credits cards like me then also I would suggest to get this due to the offers they provide. The card does not have any extra charges other than what you spend. Also, closing this card is not heck like others, you need to simply deactivate it from app. They also have referral program running where you get 500₹ for each approval. You can use my invite code to increase chance of approval.

code don’t work

Thanks for the update. Links should work fine. You can use YODA83333 code.

Bhai log ek number Credit Card😍 hai free delivery🚚 bhi hai, credit score💯 bhi jada nahi chaiye account opening ke liye. Aur yeh Refferal code 👉 YODA83333 enter karke 300 ruppe free bhi milega aapko.😎

Abhi he register kijiye isse👇👇

https://links.sliceit.com/invite?rc=YODA83333